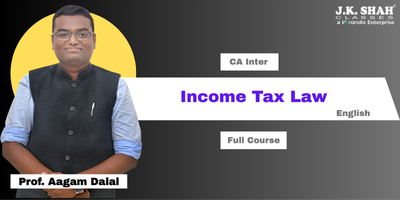

CA Inter Paper 3A Income Tax Law by Prof. Aagam Dalal prepares you for the Jan 26 exam with deep conceptual clarity. Covers Residential Status, Heads of Income, Deductions, TDS, Advance Tax, Assessment Procedures, etc. Learn through practical examples, simplified notes, and focused exam-oriented teaching for confident results.

What you’ll learn

- Concept clarity focus

- Simplified theory notes

- Practical illustrations

- Real exam approach

- Topic-wise assessments

- Regular doubt solving

- Student-friendly teaching

Course Content

63 Lectures. 71:40:44 hrs

-

Basic Concepts (Paper-3A)

4 -

Residential Status and Scope of Income (Paper-3A)

5 -

Income from Salary (Paper-3A)

8 -

Income from House Property (Paper-3A)

5 -

Profit and Gains from Business or Profession (Paper-3A)

9 -

Set off and Carry Forward (Paper-3A)

3 -

Tax Collected at Source (Paper-3A)

2 -

Tax Deducted at Source (Paper-3A)

3 -

Computation of Total Income (Paper-3A)

2 -

Agricultural Income (Paper-3A)

2 -

Clubbing of Income (Paper-3A)

2 -

Other Exemptions (Paper-3A)

1 -

Deduction from GTI U/C VI-A (Paper-3A)

4 -

Income from Other Source (Paper-3A)

3 -

Capital Gains (Paper-3A)

9 -

Advance Tax (Paper-3A)

1

CA Inter, Paper 3A - Income Tax Law - Prof. Aagam Dalal

4,999.00

6,499.00

-

63 Lectures

63 Lectures

-

71:40:44 hrs on-demand video

71:40:44 hrs on-demand video

-

Valid Upto : 12 Months

Valid Upto : 12 Months

-

2 downloadable resources

2 downloadable resources

-

2.5 Times Views

2.5 Times Views

-

₹70.41 / Hour

₹70.41 / Hour

-

English | Full Course

English | Full Course

Could not find what you are looking for? Click here